Pritzker delays Illinois’ tax deadline to July 15

By REBECCA ANZEL

Capitol News Illinois

ranzel@capitolnewsillinois.com

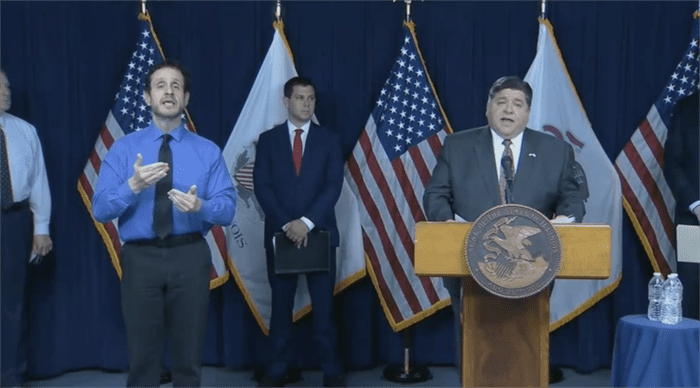

Gov. JB Pritzker announced a number of financial initiatives Wednesday to assist owners of bars, restaurants, hotels and other small businesses during the economic slowdown caused by the novel coronavirus pandemic.

By Friday, he said, owners of businesses with fewer than 50 employees and less than $3 million in 2019 revenue can qualify for a piece of $90 million in state emergency assistance through three new programs.

Pritzker additionally is pushing Illinois’ tax filing deadline from April 15 to July 15 to match the federal government’s action.

The first of the state’s new programs, called the Illinois Small Business Emergency Loan Fund, caters to businesses outside of Chicago. That program includes $60 million for loans worth up to $50,000. Each allows five years for a borrower to make payments, with a delay window of six months.

That offers “crucial time for business owners to begin recovering from the economic impact of COVID-19,” Pritzker said during a daily press briefing in Chicago.

The second program also focuses on businesses outside of Chicago, “specifically in areas with low to moderate income populations,” the governor said. The Downstate Small Business Stabilization Program provides grants up to $25,000.

The Hospitality Emergency Grant Program offers funds to owners of hotels, bars and restaurants for payroll, rent and job training costs, as well as technology upgrades to allow for pickup or delivery of food and beverages, “which for now have become central to many restaurants staying open,” Pritzker said.

Applications for the loans and grants are available at coronavirus.illinois.gov or on the Department of Commerce and Economic Opportunity’s website.

“Hotels throughout Illinois are among the most impacted industries when it comes to economic decline over the past month,” Michael Jacobson, president of the Illinois Hotel & Lodging Association, said. “…The damage is worse than the impacts of 9/11 and the 2008 recession combined.”

These new programs could allay the need for additional layoffs, he added. In “just the last several days,” there were “tens of thousands of layoffs” and the association expects that number to reach 120,000.

Pritzker also disclosed a number of initiatives his administration is undertaking to financially support other groups of Illinoisans.

“We are all concerned about the economy, for our workers and small business owners who have been displaced through no fault of their own, and for our efforts to create a soft landing so that we can push through this pandemic and return to a growing economy that lifts all boats,” Illinois Treasurer Michael Frerichs said. “However, make no mistake, our decisions should be guided by medical experts and science, not by television talking heads and Twitter posts.”

The governor urged homeowners to contact their mortgage servicer to take advantage of an initiative Pritzker said he helped negotiate. Institutions, including the federal government and Fannie Mae and Freddie Mac, that own mortgages agreed to offer multi-month payment delays.

His office additionally sent memos to the three national credit bureaus asking them not to diminish Illinoisans’ credit ratings due to the current “instabilities.”

Frerichs said his office “rolled over $200 million in investment notes, or loans,” to the comptroller’s office to pay medical bills. Because the treasurer is permitted to invest up to $2 billion in Illinois’ bill backlog at a reduced rate, as opposed to a 9 or 12 percent interest rate, this step will save money, he said.

“The enduring impacts of COVID-19 on Illinoisans’ lives and livelihoods will be significant,” the governor said. “We must take every action possible to help people all across our state.”