Illinois State officials warn of possible looming recession

Amid COVID-19 outbreak, revenues could fall 20 percent

By PETER HANCOCK

Capitol News Illinois

phancock@capitolnewsillinois.com

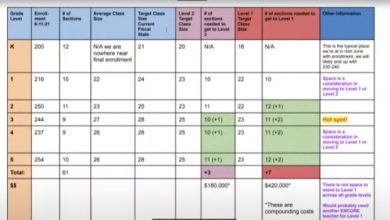

SPRINGFIELD – A commission that advises the General Assembly on revenue and economic issues is warning that a slowdown of business activity caused by the COVID-19 outbreak is likely to bring about a recession that could cause a 20 percent drop in state revenues, spread out over a number of fiscal years.

The Commission on Government Finance and Accountability, or CoGFA, gave that warning as part of its three-year budget forecast, which it is required to make annually. Those forecasts include an analysis of potential threats and opportunities to the state budget.

“While the certainty of the country, and world, plunging into recession seems to grow each day, attempting to value the impact of COVID-19 on state revenues is virtually impossible,” the report stated in the section dealing with economic threats. “With that caveat, it seems reasonable to offer a scenario with more devastating impacts on revenues in the near-term than even the ‘Great Recession.’ As a result, should revenues experience a peak-trough decline of 20 percent, a revenue reduction of over $8 billion would be experienced, although likely spread over multiple fiscal years.”

CoGFA is an agency made up of 12 legislators, divided evenly between the House and Senate, and between Republicans and Democrats, and staffed by financial experts. It is headed by a full-time executive director, Clayton Klenke.

In an interview Wednesday, Klenke described the possibility of a 20 percent decline in revenue as a “worst case scenario,” based on the state’s experience in previous recessions.

During the recession of 2001-2003, caused largely by the burst of the “dot-com bubble” on Wall Street, followed by the terrorist attacks of 9/11, state revenues in Illinois fell about 5.5 percent, or about $1.3 billion.

The Great Recession of 2008-2009 that followed the U.S. housing market collapse produced a much sharper decline, 8.7 percent, or a little more than $2.5 billion.

State revenues have generally been growing since then, except for fiscal years 2016 and 2017 when there was a temporary reduction in tax rates, and so a recession worse than the Great Recession would have a significantly larger impact

In early March, CoGFA issued an economic and revenue forecast for the upcoming fiscal year, which begins July 1, that said the outlook was generally good, although economic growth was expected to slow somewhat. That report estimated total state revenues for the year at a little more than $40.6 billion.

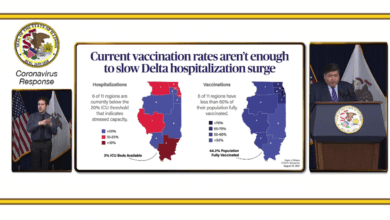

Last year, Moody’s Investors Services issued a report identifying Illinois and New Jersey as the two states that would be least able to weather a recession. In the case of Illinois, that was based the state’s lack of cash reserves and its high fixed costs for debt repayment, its backlog of unpaid bills and pension obligations.

As recently as early March, however, the report noted that Moody’s Analytics had described Illinois as being, “in decent shape for a state facing a slowdown in manufacturing, poor agricultural conditions, and numerous demographic and fiscal problems” and that the state’s economy was “doing better than it has in some time.”