Mahomet-Seymour sees increase in school facility sales tax money after first two years of internet sales tax being added

By Dani Tietz

Tax dollars are on Mahomet-Seymour constituents’ minds as they head to the polls to vote on the Nov. 8, $59.4 million referendum.

Should the measure to build a new junior high school pass, property taxes will increase to cover the expense. Since bond interest values are not as stable as in the recent past, the district used a 4.25 percent interest rate as an estimate when they published expected property tax increases. The Federal Reserve has increased interest rates six times in 2022, and are expected to continue the trend in 2023.

Currently, Mahomet-Seymour property owners are taxed at a rate of 4.6254 percent. Should the referendum pass, that rate is expected to increase to an estimated 5.1554 percent. Currently, Mahomet-Seymour has one of the lowest tax rates of the 12 school districts in Champaign County. An increase in that rate would place Mahomet-Seymour at #5 of the 12 districts.

Taxes paid are a function of both the rate and the assessed value. While Mahomet-Seymour currently has one of the lowest rates in Champaign County, the median home value is also substantially higher than any other district in the county.

The following table shows what the median homeowner currently pays in each school district:

The following table shows how the median homeowner’s property tax rate would change in comparison to other median homeowner’s tax rates should the $59.4 million referendum pass.

For all homeowners, the projected property tax increase could look like this:

Should the referendum pass, this increase will continue until 2042 when the district plans to come back to taxpayers should the district continue to need space or facility upgrades.

Property taxes are not the only way to pay for facility improvements or expansion, though.

In 2009, voters in Champaign County gave the nod to a one-percent increase in sales tax in order to help local school districts with expenses related to school facility maintenance and expansion or School Resource Officers and Mental Health Providers.

Alongside paying for Middletown Prairie Elementary Phase I and Phase II, Mahomet-Seymour has used nearly $600,000-$650,000 annually to renovate the Mahomet-Seymour fieldhouse; update parking lots; purchase land; install air conditioning units at Sangamon Elementary and MSJHS; renovate the MSHS auditorium, and update electrical and security systems, among other projects.

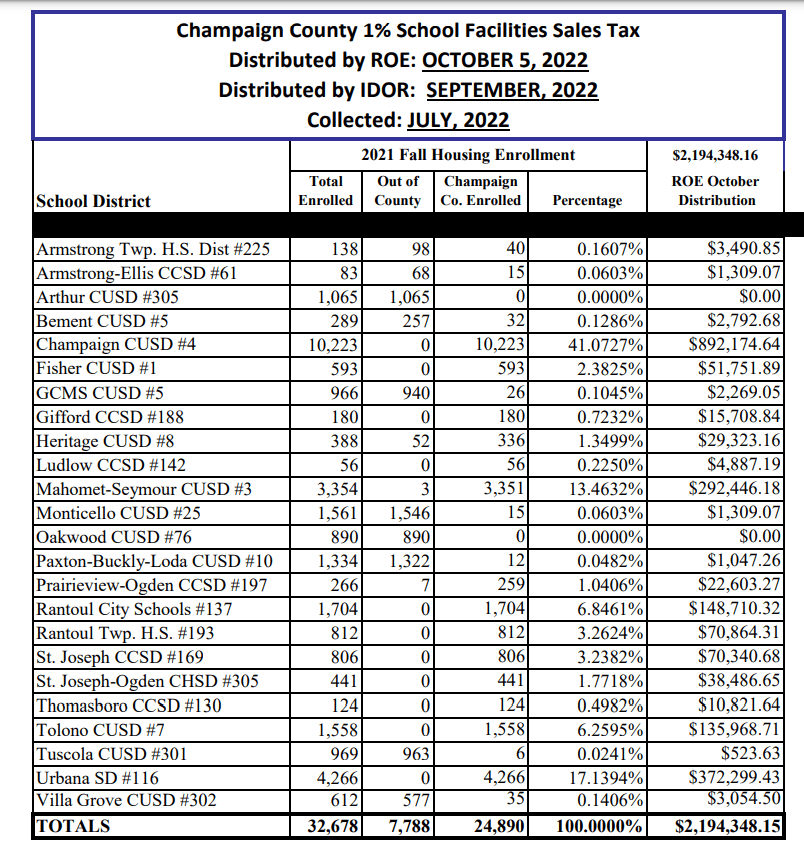

Annual bond payments for Middletown Prairie Elementary are nearly $1.2 million while Mahomet-Seymour has received at least $2 million from the school facility tax each year, and most years more. Those payments are made via the Regional Office of Education which divides the total amount of the one-percent sales taxes based on how many students attend each district. Those numbers are based on enrollment in September each year, and the dollar amount is adjusted in January.

Originally, sales tax on internet sales was not included in the school facility sales tax dollars because the state of Illinois did not require online sellers to collect them. That changed in 2020. By Jan. 2021, Champaign County School Districts saw an increase in their monthly distribution from the Regional Office of Education.

Mahomet-Seymour, for example, collected an average of $188,740.55 per month in 2015 whereas the average facility sales tax dollars per month has been $277,621.40 in 2022. Even during COVID mitigations in 2021, the district collected an average of $230,170.33 per month.

In 2016, 2017, and 2018, the district received around $2.2 to $2.3 million annually. That number dipped to $2 million in 2019 before rebounding in 2020. In 2021, the district collected $2.3, and through October 2022, the district has collected nearly $2.5 million. If the district continues to see the monthly average of 2022, it will collect about $3 million in 2022.

Currently, the district has access to $17.5 million in sales tax dollars, according to a figure given by Superintendent Kenny Lee at a recent board meeting.

The district has told Mahomet-Seymour taxpayers that about $30 million in bonds will become available in 2031 when current bonds mature, but that number could be higher if the district continues to save current sales tax dollars and internet sales tax dollars continue to impact the school facility sales tax fund as they have since Jan. 2021.

The district has not discussed how it will use the additional sales tax funds as its approached budgets or as it’s talked about school facility needs. Earlier this year, Chief Financial Business Officer Heather Smith indicated that the district is still waiting to see if the numbers are sustainable.

Yet, should the district continue to see an increase in facility sales tax dollars with internet sales, the number left over after the district pays the $1.2 million owed for current bonds each year, could increase to about $1.8 annually.

The district has not committed to how it would allocate sales tax dollars until 2031, and even after. They have only told constituents that those dollars could be used in another phase of facility upgrades or expansion, whether that is building an additional building or adding onto current facilities.