Candidate Op Ed: Keefe looks at district finances

The following piece was submitted by Ken Keefe, a candidates for the Mahomet-Seymour School Board.

The following opinions and statements are not those of the Mahomet Daily or it’s parent company Sangamon Currents, LLC. Sangamon Currents welcomes submissions from candidates as long as they are factual (cited-we do not go in and fact check) and are not slanderous towards other candidates. The publication also welcome letters of support that follow the same guidelines.

This year’s election has eight people vying for four seats on the Mahomet-Seymour school board. Of those eight, all eight have identified fiscal responsibility as a core principle for their plans as a school board member. I wanted to take some time and discuss what I mean by fiscal responsibility, how I evaluate the board’s past performance, and what concrete steps I would take as a board member to exercise fiscal responsibility.

I define fiscal responsibility as a combination of two tasks: 1. Balancing expenditures and revenues, and 2. Minimizing our long-term debt. The first is about balancing the money that the district brings in from taxes, state funding, and the myriad fees it charges families against the expenses incurred by buildings, teacher salaries, books, supplies, etc. The second task is about reducing the total long-term debt that the school district (we taxpayers) owns.

Understanding the district’s success or failure in maintaining financial balance is really complex. It is not a simple matter of looking at the net changes of fund balances because sometimes money is added to our coffers by new debt and sometimes funds disappear because a new asset was purchased; e.g., Middletown Prairie. Because of these and other issues, I don’t think it would be fair to categorically claim that the district’s finances have been balanced or unbalanced. So, I’m going to punt on my assessment of task #1.

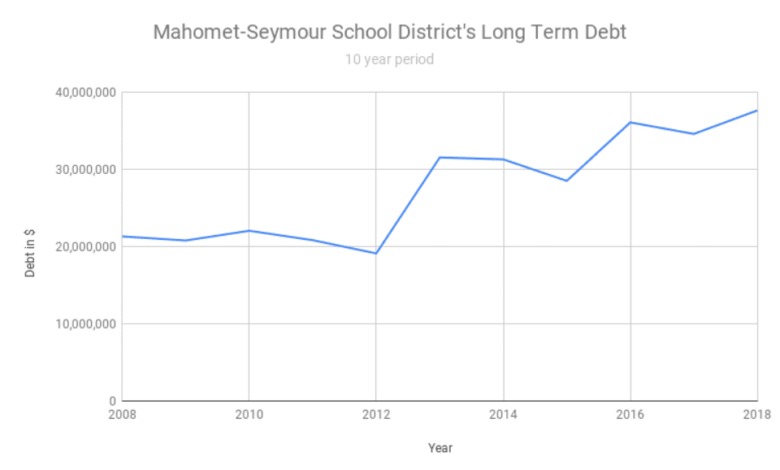

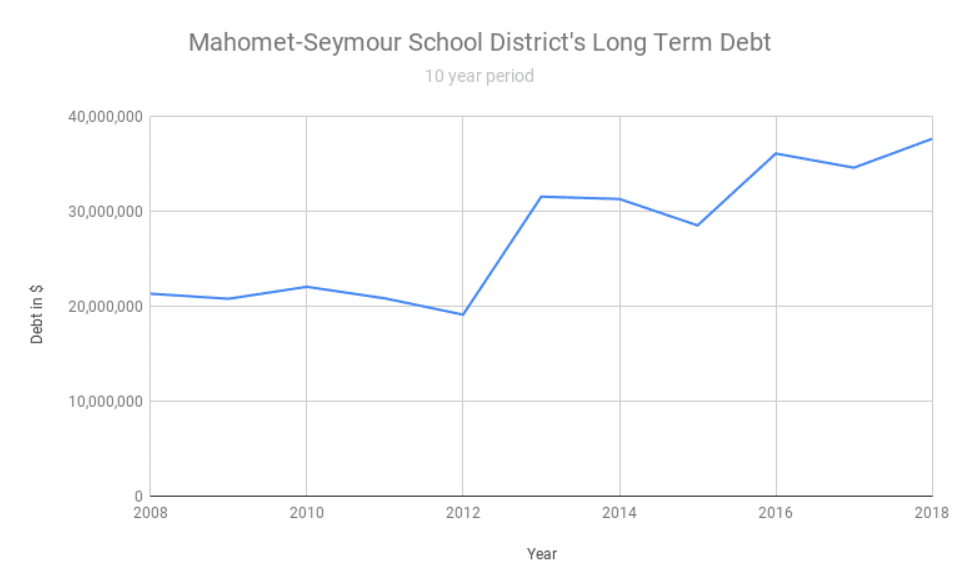

Thankfully, looking at the district’s long-term debt situation is much easier. The Illinois State Board of Education (ISBE) maintains records of every school district’s annual financial report (AFR). The reports contain a wide array of financial data on every school district for a given year, including the total long-term debt. Below is a chart of Mahomet-Seymour’s long-term debt over the past 10 years taken directly from the AFRs.

As you can see, the district’s debt was pretty level at about $20M for the years 2008 to 2012. In 2013, the board added $12.5M in new debt primarily to cover the cost of building MPE Phase 1. In 2016, the board added $13M in new debt to again pay for MPE Phase 2. Since then, the board has aggressively paid down our debt so that we are financially prepared for the next big infrastructure project that is planned. Just kidding! In 2018, the board increased our long-term debt by $3.1M, bringing our overall debt level to a historic high of $37,664,992!

Clearly, the school board has a spending problem and lacks the discipline to manage it. But, all things must come to an end. Illinois limits a school district’s allowed debt based on the equalized assessed value (EAV) of the real property in the district. You can think of it like the credit limit on your credit card. On page 28 of the 2018 financial audit that the school district paid Clifton Larson Allen to produce, it shows that our maximum allowed long-term debt is $45.9M. This means we have used up 82% of our credit limit. By the way, on that same page, this dismal long-term debt ratio earns us the lowest score (1) according to the standards defined by the ISBE.

Public Debt – The Worst Form of Taxes

Before we go any further, we should really talk about what public debt actually is. Two of the primary ways that a district gets money are taxes and loans (called bonds). These loans come with interest just like you would pay on your auto loan. The district regularly makes payments that consist of a portion that goes to interest and a portion that pays down the debt. Where does the district get the money to make the payments on its (our) debt? You guessed it! From taxes!

So, really, the two paths may look different, but they really are both taxes. One taxes the current citizens of the district and the other taxes future citizens. However, taxing our future citizens, while also kind of rude to our kids, comes with an additional penalty that brings absolutely no value to the school district: interest. In the same 2018 financial audit from Clifton Larson Allen, on page XIII, it shows that if 1. we pay these debts off on-time, and 2. we do not accumulate any additional debt, then our $37.6M debt will cost us $8,989,855 in interest.

Why would the school board waste almost $9 million of our future tax dollars? Mostly, because it is easier. It is a way for the school board to raise taxes without actually calling it raising taxes. I’ve been at the school board meetings where the board pats themselves on the back for keeping our property tax rates level for thirty-some years and our tax-rate the second lowest in Champaign county. They love talking about these two facts. You’ll probably hear them repeat it on the campaign trail! However, these talking points overlook two critical problems: 1. The board has accomplished this feat on the back of ballooning debt. And, 2. The tax rate is already at its maximum value for each of the fund categories that the board controls. This second point means that the board could not raise our taxes even if they wanted to unless they got explicit approval from the voters.

The Path Forward

Even though fiscal responsibility is commonly proposed as a governing principle, it is an extremely challenging objective that requires serious discipline. As a public servant, it can be easy to dream of all the wonderful programs and beautiful buildings that you can be a part of. It is not nearly as exciting or impressive to be able to claim that you oversaw five years of balanced budgets with a 20% reduction in long-term debt. However, this is what our district needs if it is going to be fiscally sound district in 5, 10, or 20 years. This is what we need if we want to see our children flourish and our taxes remain low.

To get there, we need to take a back-to-basics approach when it comes to spending. Just like you would stop eating out and put off buying that new guitar that you’ve had your eye on if your family’s budget was tight one month, we need to cut back where we can. For example, in 2018, when our long-term debt balance hit its historic peak, the school board decided that the time was ripe to roll out a new personal Chromebook initiative. Thankfully, they did it using a combination of savings, federal grant money, and private donations. Kidding again! Actually, they unanimously voted to pay for it by raising technology fees on struggling families and adding $600K in long-term debt through leasing agreements. While I think technology in our schools is vital, I would have voted against this particular initiative. At the time, we had way too much debt for us to be instituting a new, optional technology initiative and we already had many computers available for classrooms to share. In my opinion, giving every child in grades 6-12 a new computer was more about perpetuating an image of Mahomet-Seymour than it was about serving the academic needs of our children.

Today, the school board is poised to do this sort of thing again. At the March 11, 2019, the board was briefed on a proposal to update the Mahomet-Seymour field house. Included in the briefing were items like $571,490 to replace the synthetic rubber floor, $181,124 in new curtains, $118,346 for a fresh coat of paint, and so on. The finance committee decided that the board should keep this project at about $1,000,000 so that it would only add a little to debt to the district.

What was missing from the discussion was a thoughtful analysis of how this facility is utilized, how it benefits the core academic mission of the district, and what options were truly needed by our student athletes and which just look nice. As a board member, I would vote to wait until we have surplus funds necessary to pay for the optional items directly instead of paying for it with more debt.

I spoke with several parents of track students and they explained that students are getting injured because the floor is slippery and our track kids run really fast. I wonder if perhaps we could do only the floor and skip the $299,470 in curtains and paint. Or, maybe we only redo the track ring surface, the surfaces that are actually used during competition, and leave the central basketball court surfaces as is. I’m not saying that any one of these ideas is THE ANSWER. But, I am saying that the board has not looked into all the options for avoiding (yet again) adding to our debt.

When it comes to fiscal responsibility for our school district, there is no magic button to push. There is no wasteful program that we can simply cut. We will improve the financial health of our district through many small decisions. To truly exercise fiscal responsibility, it will take focus, planning, and discipline. The incumbents in this race have failed to demonstrate these qualities during their time on the board. Not a one of them has ever challenged the financial decisions of the board. They have agreed to whatever the board leadership has asked and now it will be up to future school boards to clean up their mess.