Mahomet-Seymour to continue discussion on financial outlook and hiring

Four Mahomet-Seymour School board members: Merle Giles, Meghan Hennesy, Ken Keefe and Colleen Schultz, asked for a hiring freeze until the board could discuss further what the financial impact of COVID-19 might be during Monday’s school board meeting.

The request came from concern of being able to maintain current staff and to continue to pay them should the United States and Illinois economies take a hit from the COVID-19 pandemic.

Board members agreed that they do not know for certain what the financial impact of stay-at-home orders and unemployment will have on the economy, but several reports, including the March 2020 report from the Commission on Government Finance and Accountability, gave insight into what could be in store on a national and state level.

The report cited James Bullard, the President of the Federal Reserve Bank of St. Louis, predicting “that the U.S. unemployment rate may hit 30-percent and the economy could see a contraction of 50% in gross domestic product (GDP) in the second quarter of 2020.

“Weekly unemployment claims were 3.3 million for the week ending March 21st and 6.6 million for the week ending March 28th, this shattered the previous record of 695,000 from Oct. 2, 1982. Illinois’ unemployment claims jumped to 114,663 the week ending March 21st and to 178,133 the following week. This was up from only 10,870 two weeks prior.”

At the release of the Commission’s FY 2021 Economic Forecast and Revenue Estimate in early March, Moody’s Analytics had described Illinois’ economy as “in decent shape for a state facing a slowdown in manufacturing, poor agricultural conditions, and numerous demographic and fiscal problems” and that Illinois’ economy is “doing better than it has in some time.”

Since the recession of 2010, Illinois’ dependence on personal income tax, corporate income tax and sales tax grew from 60-percent to 78-percent.

During the “Great Recession, state revenues fell 8.7-percent between FY 2008 and FY 2010. Between these years, net revenue from personal income tax, corporate income tax and sales tax fell a combined 16.6-percent.

The Commission’s statements noted the state’s reliance on the “Big 3” tax sources, saying, “Because of the increased reliance on these sources, significant changes in these taxes will have a greater impact on overall revenue performance. Because of this, the Commission estimates that if Illinois were to have another severe recession similar to the ‘Great Recession,’ the decline in total receipts could reach 11-percent. In terms of receipts, this would equate to a revenue loss of around $4.5 billion. This revenue reduction would likely be spread over multiple fiscal years.”

The report went on to say that the developments of the COVID-19 pandemic have changed the outlook of the state’s fiscal position.

“While the certainty of the country, and world, plunging into recession seems to grow each day, attempting to value the impact of COVID-19 on state revenues is virtually impossible,” the report stated in the section dealing with economic threats. “With that caveat, it seems reasonable to offer a scenario with more devastating impacts on revenues in the near-term than even the ‘Great Recession.’ As a result, should revenues experience a peak-trough decline of 20 percent, a revenue reduction of over $8 billion would be experienced, although likely spread over multiple fiscal years.”

Over the last four weeks, more than half a million Illinois workers have filed first-time unemployment claims. Washington-based Economic Policy Institute estimates that as many as 779,000 people in Illinois could be out of work by July, which would boost the state’s unemployment rate to 15.6 percent, according to Capitol News.

Should that come to be, it would surpass Illinois’ highest unemployment rate of 13.1 percent in February 1983.

Models from The Institute of Government and Public Affairs at the University of Illinois show that a low-severity pandemic followed by a quick recovery could result in a state decline of about $4.3 billion across calendar years 2020 and 2021.

The worst-case scenario, a severe pandemic followed by a slow, protracted recovery, could result in a state revenue loss totaling $28.4 billion through calendar year 2023.

“The COVID-19 crisis is likely to have negative implications for the finances of all local governments: counties, municipalities, school districts, transit agencies, and special districts,” the researchers write. “How local governments are impacted will depend on what revenue sources they are reliant on, their financial condition prior to the COVID-19 emergency, and the amount of rainy day funds they had saved. Governments with a local sales tax are likely to see immediate revenue shortfalls resulting from the sharp COVID-19 related economic downturn. Increasing unemployment and business closures may result in decreased property tax collections, but these impacts would lag behind significantly. We focus here on the most direct and immediate consequences to muncipal government revenues, namely the substantial revenue shortfalls due to declines in local tax collections and state aid.”

According to the Illinois State Board of Education’s 17-year fiscal profile, Mahomet-Seymour was in a different financial position coming into the 2008 recession than it was at the beginning of the COVID-19 crisis.

While the district does not provide historical financial information on its website or board packets, the district was in ISBE’s highest financial profile of “Recognition” in 2007-2009. They received a score of 0.30 for “Days of Cash on Hand,” meaning that they had between 90 to 180 days of cash on hand.

By 2010, the district was down to less than 90, but more than 30, days of cash on hand.

In August of 2010, the Mahomet-Seymour Education Association went on strike, delaying the beginning of the school year, when the union fought for a tentative one-year agreement that included reduced pay increases to the teacher salary, teachers aides and support staff.

According to The News-Gazette (Aug. 20, 2010), the district said it had given MSEA teachers a six-percent increase per year for the previous nine years. In the 2010 negotiated contract, teachers received 2.6 percent average increase in the teacher salary schedule.

In the March 30, 2020 board meeting, board member Jeremy Henrichs asked board President Max McComb and Treasurer Giles how they handled the downturn eight or nine years ago.

McComb said initially the board froze hiring, then had to go back and reduce some positions.

“We did most of that out of attrition (definition: the action or process of gradually reducing the strength or effectiveness of someone or something through sustained attack or pressure),” McComb said.

“In the meantime, until attrition took care of it, we cut into fund balances. I think that was driven by two things: I think it was initially driven by the board that we were going to keep doing what we think was the right thing to staff our district for as long as we can, and then there was also a response from the community that the community did not want to see widespread cuts. They wanted us to spend down balances to maintain programs if that’s what we needed to do.”

Giles added that ultimately that led to the board not cutting extra-curricular activities.

Giles said that the district was down about $4.5 million in coming out of those recession years.

“That’s a pretty big hit that we took, and we pulled through and survived it,” he said. “We cut enough, we were in negative balances in some of those years.”

McComb said that the district took a long-term approach to the financial situation, coming back into an even budget a year or two ago.

The current ongoing topic of discussion for the Mahomet-Seymour School Board is whether or not to continuing with the hiring of seven new teaching positions at $270,000.

McComb said the new hires are modest in comparison to what the district would like to do.

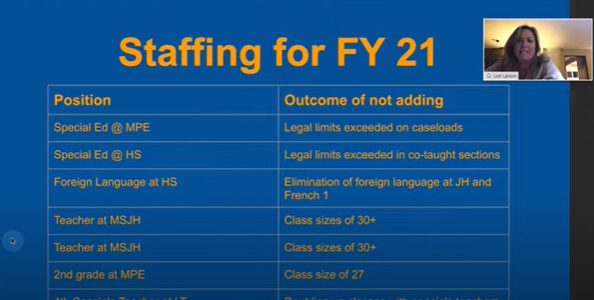

The projected 2020 hires were to include a Special Education teacher at Middletown Prairie and Mahomet-Seymour High School, a Foreign Language teacher at the high school, two teachers at Mahomet-Seymour Junior High, a second-grade teacher at Middletown Prairie and a fourth “specials” teacher at Lincoln Trail.

Superintendent Lindsey Hall also said that there will also be teachers retiring or leaving the district.

The jobs had already been posted and Hall said that at least one job offer had already been made.

Part of McComb’s concern with not going ahead with hiring at this point is that he believes the district “risks finding really good people that right now we probably have a shot at landing.”

Hall told board members about the impacts not hiring these teachers would have on the district: in the special education department, legal limits would be exceeded in caseloads, they would have to eliminate foreign language at Mahomet-Seymour Junior High, class sizes of 30+ students at the junior high, second-grade class sizes of 27 at Middletown Prairie and doubling of classes in specials at Lincoln Trail.

With a growing population, the four Mahomet-Seymour Schools have seen increased enrollment while filling the available classrooms in each school. In September, Hall talked about how the district was not quite out of space, saying that there was still room for teachers to use carts at the upper levels.

Since 2015, Mahomet Seymour has been above the state average on class sizes.

McComb recognized that the Mahomet-Seymour School District is on the ISBE Financial “watch” list coming into this crisis, which puts the district in the lowest financial category in the state with eight other districts.

“That’s mostly because we spent balances down below what the state recommends,” he said. “We’ve always been comfortable with our balances, and we feel like we are good there.

At the April 6 meeting, Chief Business Officer Heather Smith said that the Mahomet-Seymour School District budgeted to have $2 million remaining in funds at the end of the fiscal year. Because the district does not provide its financial information online, it is unclear what the expenditures per day are, but in FY 2019, they were $74,029, according to information provided by ISBE.

Between 2015 to 2019, the average expenditure per day increased on average $2,246.75, so it can be assumed a reasonable estimate of expenditures per day in 2020 would be $76,000. Using this estimate, the district is operating with 27 days of cash on hand.

If today the district ended the fiscal year with 90 days of cash on hand (the low end of the range they had in 2008), they would have a year-end $6,840,000 fund balance in the operating funds. If the district ended the fiscal year with 180 days of cash on hand (the upper end of the possible range in 2008), they would have a $13,680,000 year-end fund balance in the operating funds.

“I think it’s important to remember that we have gone through lean times previously, but we have not gone through anything what we are going to go through on a global level,” Hennesy said on March 30. “This is really unprecedented and I think caution in the face of knowing the federal government is not going to have money and the state governments are not going to have money, that it would be prudent to proceed with caution and maybe even be overly cautious in this point in time.”

“We owe the people who are going to count on us to be able to pay them next year to be able to do that.”

“I do think that we are going to have to make some hard decisions, and if we can freeze right now and make some of those decisions a little easier, I would be for that.”

Schultz, who holds a Ph.D. in economics and teaches both economics and statistics at the University of Illinois, agreed with Hennesy on the 30th and echoed concerns on April 6.

“There was a recession coming before COVID,” she said. “And now it’s going to be exacerbated; some people are saying it’s going to be slight, and some people are saying it’s going to be worse, but I haven’t found anyone who said it isn’t going to be significant; that’s an economist, that is actually looking at these things.”

“I think we need to do everything we can to prioritize, providing stable compensation and protection for our employees,” Keefe said.

Schultz agreed that the board’s top priority needed to be doing what needs to be done to pay employees for the next three years.

She said that if the state says a school district needs to reduce its budget by 10-percent, she wants to make sure that everyone the district employs would be paid.

“It is devastating to a family to lose your job because of budget cuts,” Schultz said.

Schultz said that currently the state is operating on 2019 tax money, which was not impacted by COVID-19. As they begin to get 2020 tax money, it will be much lower because of the stay-at-home order and people losing their jobs.

“I think it’s the year after that we can reasonably predict a lower budget; we don’t want to hire a bunch of people, and then a year from now find ourselves in a place where we don’t have enough money to cover all these salaries,” Schultz said.

Her suggestion was that the district take inventory of what is needed and who is currently employed to help fill some of the expected gaps.

“If our fears are not realized, we could open up the hiring and shift back,” Schultz said.

McComb asked if Schultz was suggesting that the district break the law, especially in light of the need for special education teachers.

Schultz said that she was not suggesting that, but rather the district look at who on staff is qualified to fill different positions, and begin there.

“It is not because I don’t think these positions are valuable,” she said. “If it were up to me, and money was no issue, the junior high would get 10 new teachers next year, and MPE would have multiple behavioral specialists to come in and come beside the staff to help out, there’s tons of things that I could think about that I would love to have; all of these positions, plus 30 more.

“I’m just trying to be fiscally conservative and maintain our ability to pay the teachers we have now for the medium-long term, three to five years.

Hall said that the district is not at ideal staffing for the students and services that need to be filled.

“We’re talking about basic meeting of student needs,” Hall said.

Giles said that he believes the board needs to be very conservative.

“I don’t trust the state, I don’t trust the county to get us property taxes on time,” he said. “This is our primary revenue line for education and salaries, and it pains me, but I think we’ve got to be extremely cautious and I think we are going to have to cease hiring and figure out how we are going to work around it.”

The board will continue its discussion about the district’s financial position and hiring needs at a special board meeting on April 13, 2020 at 6:00 pm.