Fact Check Hennesy, McComb and Widener: TIF Funds

On Jan. 31, 2023, Mahomet-Seymour Board President Max McComb wrote an opinion piece for the News-Gazette in rebuttal to what board member Meghan Hennesy said at the Jan. 17, 2023, regularly scheduled board of education meeting. The following are just excerpts from those pieces. Hennesy’s speech (Jan. 17) can be found here. McComb’s opinion piece (Jan. 31) can be found here.

This project is not an attempt to look at every issue that was brought up in its entirety. This publication has reported on some of these issues before. In those cases, links are provided so that each reader can learn more about the issue. The articles that follow are an attempt to look at the claims each board member brought up. In some cases, one board member named others. In those cases, this publication looked at what happened surrounding those claims. All of the articles can be found on this page. Each article also includes documents and videos referenced.

We understand that this piece comes two months after these events took place. We have taken time to watch discussions of every topic over the last three years, to look at board agendas and minutes from the same time period, to read emails, to send FOIA requests and to undertake a major project in analyzing TIF data. This work took time, and that is why it took so long to complete.

Quotes from Meghan Hennesy

“We held multiple meetings about expanding a TIF for the expansion of this road [South Mahomet Road] that’s going in. In my opinion, the district traded a $1.5 million… we owed $1.5 million to $3 million to put in the road, would have been our responsibility as developers of this site. And what we have given up is well over $10 million over the life of that TIF. That is not appropriate for the taxpayers. We just keep asking the taxpayers to burden this. And that road is going to also have a secondary impact of bringing more houses, more kids, more students to school buildings that are already busting at the seams.”

Meghan Hennesy

Quotes from Max McComb

“Her claims about agreements between our school district and the village of Mahomet regarding property transfer and TIF details were just not true.”

Max McComb

Quotes from Mayor Sean Widener

“Widener said he doesn’t know where Hennesy got the $10 million figure and noted the true number is closer to $3 million. He said the improvements were required, and extending the TIF district relieved the district of those requirements.

“’We took over responsibility of building the infrastructure,’ Widener said. ‘At the end of the day, they got a pretty good deal. My point is, we’re two taxing bodies serving the same constituents. We have to work together.’”

News-Gazette on Sean Widener

Looking Back

The answers to these actual million-dollar questions are hard to figure out. We’ve been working on acquiring the actual numbers from the Village of Mahomet and the Champaign County Clerk’s office for 18 months now.

Because neither taxing body responsible for collecting property tax data and distributing property tax and TIF dollars could provide the appropriate data, we decided to do the work.

This journey started when we were able to locate the total net taxable value, the parcel extension, and the TIF increment from the Champaign County Clerk for the years 2018, 2019, 2020, and 2021. For the first time, information on the values associated with the East Mahomet TIF was consolidated into one document and made available on the Clerk’s website.

When the Champaign County Clerk’s office was asked to provide the same numbers from 2000 until the year 2017, this publication was informed that a change in the data system would prevent that information from being obtained.

Through FOIA, this publication also asked the Village of Mahomet for the same data. They responded with data that, at times, was responsive, but incomplete and scattered. The pdf format they provided was also unusable for analysis. With the documents they provided, there was no way to organize that data into a complete picture of the East Mahomet TIF for readers.

Because the Village of Mahomet or the Champaign County Clerk’s office could not or would not provide the total data or the individual commercial parcel data for all of the fiscal years from 2000-2023, this publication decided to use the data it did have in Feb. 2023 to make an educated estimate on the amount of property taxes diverted from the District into the TIF fund year-after-year.

Piecing together data from the various documents provided by the village and county, the values for the increase/increment within the TIF by parcel type were determined for 72-percent of the years since 2004. For any gap of only one year, the previous year’s value was used as a proxy. For multi-year gaps, the increase was divided equally over the gap years to ‘smooth’ the values between the years where data was provided. The data shows that growth likely happened unevenly and earlier, but smoothing was a reasonable and conservative way to estimate the data. For the years 2000-2003, a conservative estimated value of zero was used.

For each year, values were gathered for the parcel types that were subject to the 50-percent pass-through for that year, as these categories changed slightly several years into the TIF.

Historical data on the tax rates was gathered from the Mahomet-Seymour School District website, and the rates were applied accordingly.

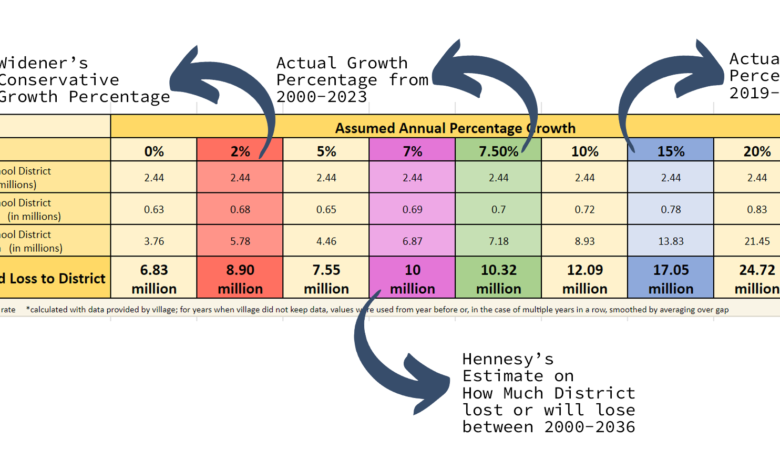

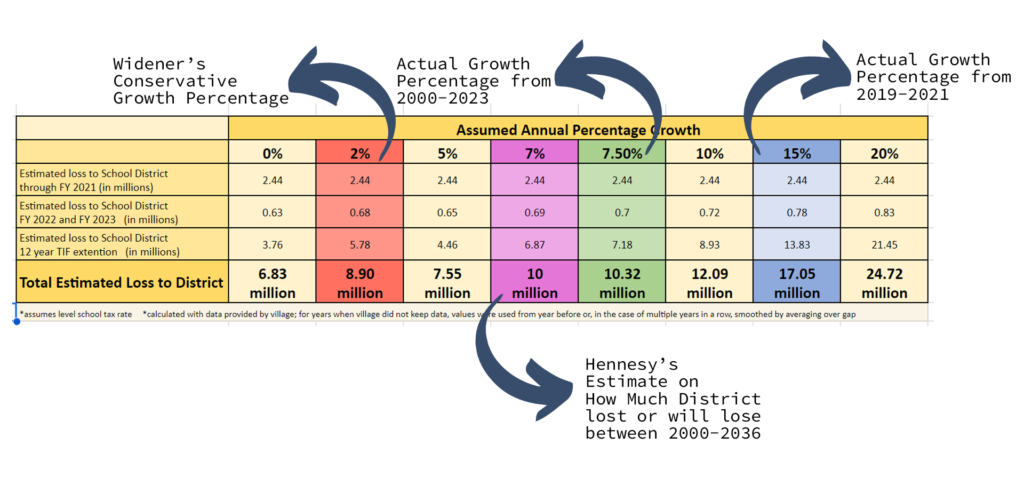

As that data was compiled, we were able to estimate the amount of tax dollars that the Mahomet-Seymour School District has and will miss out on until the TIF district has expired in 2036, at various levels of future growth.

After the Jan. 17 and Jan. 31 commentaries by Hennesy and McComb, and statements made by Widener, this publication once again set out to understand how much property tax had been diverted from the Mahomet-Seymour School District to the TIF fund, which goes to fund infrastructure that encourages development.

The entire email between this publication and Widener is embedded in this article, but in short, Widener’s number is an estimated loss to the District in the 12 years after 2024. He wrote:

“When we estimate the 50% of the taxes generated from commercial properties beginning in tax year 2024 (the first tax year of the 12-year extension) with an assumed 2% growth escalation for the next 12 years (final in Tax Year 2035), the District’s contribution is approximately $3,000,000.

We acknowledge that our numbers are conservative assuming 2% growth in value. This is because we have to use conservative growth assumptions for various bonding reasons. We hope they are wrong and our growth is much greater. This has proved to be true in recent years which means the amount of money the TIF fund keeps for infrastructure projects is greater, and also would mean the disbursements paid out to the taxing bodies also increases at the same proportions.”

Sean Widener via email

Hennesy estimated numbers over the life of the TIF, which will be 36 years once it is expired. Widener, on the other hand, did not consider all the commercial tax dollars that were put into TIF funds, but only looked ahead into the 12-year TIF extension with a conservative estimate for growth.

Estimating the District’s lost revenue during the extension requires estimates of the future level of growth in the TIF district area. These can range from assuming no growth at all, to assuming growth slows down, to assuming the growth rate stays where it has been the past few years to assuming the growth rate increases over the next decade.

When these questions were asked in February, it was hard to know what the year-to-year commercial growth in the East Mahomet TIF from the fiscal years 2000-2023. But, through current and prior research this publication has done, we could tell the true year-to-year growth in commercial property in the East Mahomet TIF over the last four years has been 15-percent.

While no one can know exactly how commercial property value will increase in the future, this publication estimates that during the 12-year period of the TIF extension, the Mahomet-Seymour School District would miss out on approximately $14 million more in commercial property tax revenue, not $3 million as Widener stated.

The Mahomet Daily’s $14 million estimate was made prior to the March 7 Village of Mahomet Planning and Zoning Commission meeting where the commissioners heard about plans for commercial development on 21.5 acres of land located on the corner of Oak St. (US150) AND S. Prairieview Road Intersection. This will likely accelerate its value.

The development will be made possible by TIF funds, which are currently pulling South Mahomet Road through the Mahomet-Seymour School District’s 70 acres. The infrastructure also includes water and sewer access. In Phase II of the project, South Mahomet Road will connect with Prairieview Road. Normally, individual developers are responsible for “pulling” roadways, water, and sewer from previously developed areas to develop their land.

Hennesy referred to the South Mahomet Road extension in her statements. When the District purchased the 70-plus acres on the east side of the Village, the plan was for South Mahomet Road to follow along the railroad before crossing over to meet up with Prairieview. This design ensured roads would not run through the Mahomet-Seymour School District’s property.

The District was obligated to construct a north-south road on the east side of their property, giving access to the campus. The original estimate for that road was $1.5 million, and local officials cited that may translate to $3 million today.

Hennesy quoted similar numbers in her Jan. 17 comments. She also estimated the Mahomet-Seymour School District, which has and will continue to ask taxpayers for additional taxes dollars to fund facilities, will have lost $10 million in TIF-diverted funds from 2000-2036. Hennesy’s belief is that the trade-off, putting property tax dollars into the TIF in exchange for a road that will encourage more residential growth on the east side of the Village, is not beneficial to the district seeing as it will likely add stressors to a district that is already beyond capacity in some buildings.

Her estimate came from work this publication has published in the past. Currently, about $330,000 of commercial property tax dollars are diverted from the school district to the TIF fund each year. Hennesy believes the district could utilize that money right now in facilities, teacher salaries, or resources for students rather than help developers.

Widener estimates a 2-percent growth percentage because banks want to see a “conservative” estimate as the Village borrows against future money within the TIF district. Whether or not the Village can look back from 2000-2018 to see what the growth percentage in the East Mahomet TIF District is cannot be known with the information we have been given. Still, the Village can see from the Champaign County Clerk reports that growth year-to-year since 2019 is 15 percent.

Again, we can’t predict what will happen in the future, but email documents from the Village of Mahomet show that the land owned by Visionary Hospitality, Purnell Development is likely to develop as South Mahomet Road makes its way east. This land is zoned with commercial and residential visions.

The middle ground, the actual year-to-year percentage growth (7 percent) in assessed value is, too, a conservative mark. In this, Hennesy’s estimate of $10 million diverted from the school district to the TIF district from 2000-2036 is likely correct.

The Village of Mahomet has a second TIF District, often referred to as the “Downtown TIF.” Established in 2019, this TIF collects 100 percent of the residential and commercial property tax increment and will do so for the next 23 years. It is too soon to understand how that will affect the school district financially, but these estimates do not include that data.

Municipalities that establish TIF districts believe that diverting funds from taxing bodies for two or three decades in order to encourage development pays off long-term in that the EAV in the close of the TIF district is greater than it was before it was established.