Pritzker paints two budget pictures: One with graduated tax, one without

By JERRY NOWICKI

and PETER HANCOCK

Capitol News Illinois

news@capitolnewsillinois.com

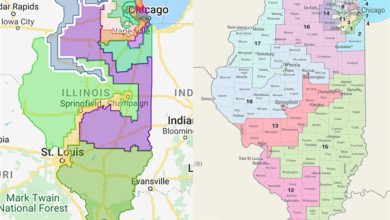

SPRINGFIELD – Gov. JB Pritzker has tied his second-year state budget proposal to the unfinished marquee policy initiative of his first year – a constitutional amendment that allows the state to impose higher income tax rates on higher income earners.

If voters approve that graduated income tax initiative in the November general election, Pritzker is asking for a roughly $1.6 billion increase in state general revenue fund spending for the upcoming fiscal year, which begins July 1.

That would bring total state spending in that fund to just over $42 billion, helping to pay for a $350 million increase in K-12 education, a 5-percent increase in higher education operating funds and an increase in contributions to the state’s backlog of unpaid bills and unfunded pension obligations.

If the constitutional amendment fails, overall state spending would increase by about $200 million from a year ago in the general fund under the governor’s proposal, equaling roughly $40.6 billion. In that scenario, $1.4 billion in spending authority would be held in reserve in a combination of budget cuts and withholding of new spending on state programs.

“Because this reserve is so large, it inevitably cuts into some of the things that we all hold most dear: increased funding for K-12 education, universities and community colleges, public safety and other key investments – but as important as these investments are, we cannot responsibly spend for these priorities until we know with certainty what the state’s revenue picture will be,” Pritzker said in his budget address in the Illinois House chamber Wednesday, Feb. 19.

To pass, the graduated tax needs approval from 60 percent of those voting on the question or the majority of those voting in the election in November.

But Republican leaders in the General Assembly argued that the choice between the two budgets is a false one, and Pritzker’s address was nothing more than a sales tactic for the graduated tax.

“The reserves he’s calling for are a marketing plan to sell his (graduated tax) increase,” Senate Minority Leader Bill Brady, R-Bloomington, said. “If those resources weren’t there, I don’t think this is the way he would have approached the spending plan and it’s not a way we would approach it.”

Both House and Senate Republicans called for “greater efficiencies” and reduced state spending in certain state agencies. They also said $656 million in increased base revenue projections for the fiscal year mean the level of state investment in programs from a year ago can be maintained without new tax revenues.

House GOP Leader Jim Durkin, of Western Springs, also pointed to a surplus of roughly $180 million from the current year’s operating budget as a sign of the effectiveness of bipartisan budgeting.

“We have the money to be able to fulfill our obligations in every need for the state of Illinois,” Durkin said in a news conference. “So, to say that you go on two different tracks and say, ‘Well, you know, if you don’t pass a constitutional amendment, we’re going to have a world of hurt that’s going to be delivered upon state employees, and also state retirees as well, and health care providers.’ I just felt that that’s a wrong approach.”

* * *

BUDGET REACTION – FISCAL OFFICERS: Illinois’ chief fiscal and investment officers lauded the economic opportunities afforded if voters approve Gov. JB Pritzker’s “fair tax” proposal in November. But several Republican lawmakers said they objected to the governor’s plan, outlined in his annual budget address Wednesday, Feb. 20, to cut spending in several key areas if the constitutional amendment fails to pass.

The proposal to establish a graduated income tax structure — which would levy higher income tax rates on higher thresholds of income — is a hallmark of Pritzker’s policy agenda.

His $42 billion budget proposal includes $1.4 billion the state would expect to receive if the amendment passes on the November general election ballot. But that spending authority would initially be set aside pending the results of that election.

“Because this reserve is so large, it inevitably cuts into some of the things that we all hold most dear,” Pritzker said, “…but as important as these investments are, we cannot responsibly spend for these priorities until we know with certainty what the state’s revenue picture will be.”

Democratic Comptroller Susana Mendoza said key items on her priority list — including higher education investment, safety-net contributions and decreasing Illinois’ bill backlog — depend on voters deciding “which direction they want the state to move.”

The choices are driving “a little bit more fiscal security and greater investment in job creation, building the economy, or the status quo, which frankly hasn’t been working for us,” she said.

Democratic Treasurer Michael Frerichs, who said he still wants to hear details about Pritzker’s budget proposal, highlighted the state’s need to make pension payments. Voters need to approve the income tax change first, he said, to create a “virtuous cycle.”

“When we pay down our bills, we pay less in interest. When we pay down our pension unfunded liability, we improve our credit rating, which means when we go out for bonding, we pay a lower interest rate,” Frerichs said. “If we do things right up front, it will save us money years down in the road.”

* * *

BUDGET REACTION – BLACK CAUCUS: Members of the 32-lawmaker Illinois Legislative Black Caucus said Gov. JB Pritzker’s budget proposal for the fiscal year starting in July is a good start but needs more money and support for people of color.

“I was so pleased to hear so many things that the governor mentioned that have been issues that the black caucus has fought for for many years,” said black caucus chair Sen. Kimberly Lightford, D-Maywood.

Every member of the black caucus is a Democrat, the same party of Pritzker, who delivered his second annual budget address to members of the House and Senate Wednesday, Feb. 19, at the Capitol.

Among the top issues discussed by caucus members after the address was education funding, from kindergarten through college graduation.

Pritzker’s proposed budget would increase K-12 school funding by $350 million, but $150 million of that is tied to the passage of a graduated income tax. That tax will go before voters in November in the form of a constitutional amendment that increases income taxes on people earning more than $250,000 annually.

“While his speech suggests that $350 million (would) allocate toward funding, we know the reality based on the revenue outlook,” said state Rep. Will Davis of Homewood. “Our message to the governor is this funding level must be realized.”

PRESS RELEASE FROM SENATOR CHAPIN ROSE ON PROPOSED BUDGET

“There’s a lot that I agreed with him on, and there were certainly some worthy priorities in this budget, but the Democrats just passed one of the biggest income tax hikes in state history in 2017, and it’s still not enough,” Rose said. “They want more money in tax increases to cover their $1.6 billion in new spending. At the end of the day, I am concerned that it seems like it’s never enough for them.”

SENATOR SCOTT BENNETT’S COMMENTS ON PROPOSED BUDGET

“If we want to continue to grow as a state, we need to continue to make investments in opportunities for our children,” Bennett said. “The governor’s budget proposal focuses on keeping our best and brightest in Illinois.”

“I’ve always believed that higher education is the best and smartest investment that a state can make,” Bennett said. “I look forward to working toward a budget that achieves stability and certainty for the University of Illinois, Parkland College and Danville Area Community College.”