BY DANI TIETZ

dani@mahometnews.com

Mahomet, Ill. – Champaign County property owners can expect their property tax bills to arrive within the next few days.

According to the Champaign County Clerk’s office, bills will be mailed out May 30 and May 31, and are already available to view on the Champaign County Property Tax Inquiry website.

Typically, property tax bills are mailed on May 1 with a due date for the first installment 30 days later. But this year, the Clerk’s office’s process was delayed after the Illinois Department of Revenue issued the final property assessment equalization factor on April 25.

The final multiplier of 1.0000 was the same as the tentative 1.0000 issued in August.

While residents may have breathed a sigh of relief, knowing they would have at least 30 more days before property taxes were due, local school districts, who hit their lowest funding stream in January through April, have been holding their breath throughout May.

Champaign County Schools generally receive the bulk of their property tax funding in May, June and September.

From the 2018 property tax levy, property tax revenue accounts for 53-percent of the total revenue for the Mahomet-Seymour School District in fiscal year 2019, while it makes up 73-percent of Prairieview-Ogden’s and 54.7-percent of St. Joseph-Ogden’s four main operating funds (Education, O&M, Transportation, and Working Cash).

With the 2019 fiscal year coming to a close and the 2020 fiscal year to begin in a month, districts are not only looking at ending the year in the red once payroll and invoices are paid, but the impact that not receiving property tax revenue will have on the district for years to come.

Last year, Prairieview-Ogden received 68-percent of its total property tax funds in May and June.

“Not getting around this much by June 30 will put the district in deficit spending,” PVO Superintendent Vic White said.

Without the full May and June payment, PVO will finish fiscal year 2019 in red in the education, transportation and building funds.

St. Joseph-Ogden CHSD #305 is in a similar boat.

“We have typically received around 55-percent of the (tax) levy in the spring (May/June) and 45% of the levy in the next fiscal year in September,” SJ-O Superintendent Brian Brooks said.

Brooks said he was told last week that his district would receive the same percentage of levy money that they normally get in the spring, but the date of receipt would be closer to June 30.

Brooks said if the district gets the property tax money before June 30, the district will be fine. But since the bills did not go out as planned Tuesday, he is a little more concerned.

“If we don’t get any levy money, or even if we get significantly less during this fiscal year, our budgets will be completely off and our historical financial data will be skewed for both FY19 and FY20. Depending on how much money we get in FY19, it could very easily make our balanced budget become unbalanced at the end of the year, which could have implications with the state.”

SJ-O has been in the ISBE’s Financial Recognition category, the highest possible, for four consecutive years.

“Our district has been very conservative over the years with funds, which has not only kept our tax rate low for our tax payers, but has also allowed the district to build up reserves for times like this and also for those years in which we were not getting our state money,” Brooks said.

“That indirectly saves our taxpayers as well as we are not having to pay interest to borrow money during those times.

“We have had to transfer some money out of investments for the month of June so that we can make payroll, but we have not had to borrow any money from outside of the district.”

White said PVO, which has also been recognized by ISBE in the Financial Recognition category for 12 consecutive years, will not have to borrow money, either, but will feel the impact in long-term financial planning.

“We will have to dip into our reserves,” White said.

“Currently, we will not be investing our reserves in CDs from June 17 Board meeting until we receive our early tax money (May/June payment) because we will have to pay employees and vendors.

“We will lose interest since the money will not be invested in CDs.”

White also fears the PVO district, like other districts throughout Champaign County, will see audit and financial stability hits if the fiscal year 2019 budgets end in red.

With 17 days of cash on hand at the May 21 board of education meeting, Mahomet-Seymour finds itself needing to look outside of the district for funds in order to pay for payroll and expenses throughout the summer months.

Like other school districts throughout Champaign County, Mahomet-Seymour will receive the state’s Evidence-Based Funding payment in the late spring and early summer months.

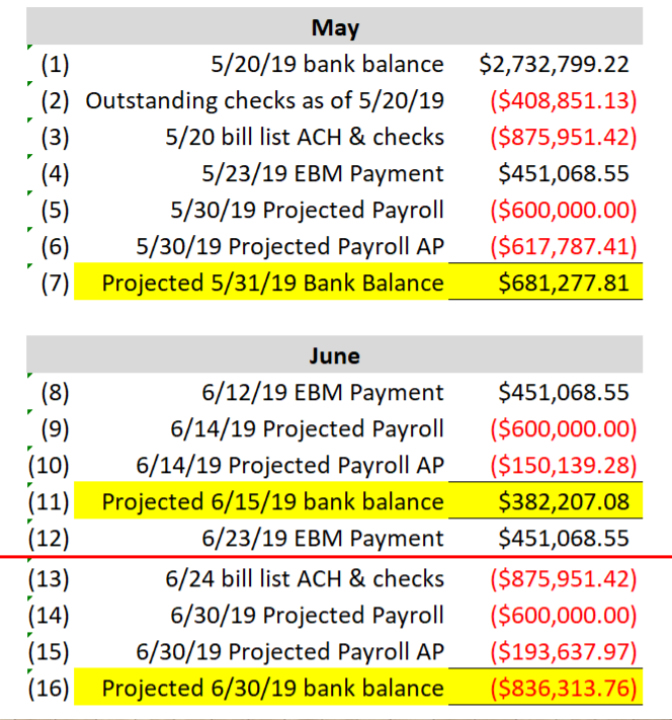

But Mahomet-Seymour’s Chief School Business Official Trent Nuxoll told the school board that the district will run out of funds by the end of June if they have not received the property tax payments as they normally would.

At that point, the district will not have received nearly $9 million from the county.

“I don’t know any public school district can operate and not receive those types of funds,” Nuxoll said.

“That’s nothing anybody can plan for, that’s been consistent money for decades.”

The Mahomet-Seymour School Board will meet at 7:45 a.m. on June 3 at Middletown Prairie Elementary to vote on approval for $3,000,000 Taxable 2018 Tax Anticipation Warrants for educational purposes and authorizing the sale of said warrants to the purchaser thereof.

Illinois School Code allows for tax anticipation warrants (105 ILCS 5/17-17) to make it through until the tax payments come in.

The loans come at a low-interest rate and are paid in full when the expected tax revenue is received.

Board member Ken Keefe asked if the district needed to revisit the total days of cash the district has on hand. The Mahomet-Seymour School District operates with 90-days cash on hand, as opposed to the 180-days ISBE suggests.

Nuxoll said if the change were to be made, tough decisions would need to be made.

“It would require a tax increase, not adding teachers when we need to add teachers,” he said.

Keefe suggested, “If we had higher days of cash on hand, we would be less likely to be worried about these warrants.”

Board member Colleen Schultz said it’s an opportunity cost issue, too.

“We have to balance out 180 versus hiring another teacher.”

Board member Lori Larson added, “or raise the tax rate.”

Nuxoll said, “Ninety-days is more realistic for us. We are inherently under-funded as proven by the evidence-based funding model with the state funding. That’s two hits on our biggest revenue sources.”

M-S Board President Max McComb said that the problem for school districts has been that they were told multiple dates for the bills to be mailed, making it difficult to plan.

But he believes that once the bills are mailed, the districts will receive money fairly quickly.

“The point is once the bills get mailed, cash will start to flow in because there are some people who pay their taxes right away,” McComb said.

As of 8:00 am on Friday, May 31, 2019, there is no property tax data showing on the Champaign County Property Tax Inquiry website (https://champaignil.devnetwedge.com/), as described in this article. I tried a parcel ID search and an address search for our property. In both cases, the inquiry returns, “No data available in table”. I’ll wait for the mailed bill and pay in 30 days.