When it comes to taxes, there is a lot to consider: every governing body has its own tax rate; every taxpayer pays multiple taxing bodies; almost every taxpayer has a different home value; the taxed amount comes from the annual assessed value.

For almost a decade now, the Mahomet-Seymour School District has talked about taxes in terms of the tax rate. Currently, Mahomet-Seymour’s tax rate is at 4.6254-percent, standing at #14 of 15 districts throughout Champaign County.

This low-rate, which has slightly increased this year but held pretty steady since 1990, has been a point the district turns to year-after-year. Yet, a month ago as Mahomet-Seymour residents received their tax bill, many noticed that the dollar amount going to Mahomet-Seymour went up from the previous year.

This is where the assessed value comes into play. Homeowners are taxed at the designated rate per $100 of assessed value, which is about one-third of each home’s value. This “EAV”, equalized assessed value, is determined by the Champaign County Assessor’s office. Tax dollars increase when tax rates go up, but they also increase when the EAV goes up. When home values increase, assessed value increases, and therefore tax value dollar amounts paid to every taxing body also increase.

Based on EAV data from the Champaign County Assessor’s office, home values in the Mahomet-Seymour School District consistently are #1 of 15 districts when looking at the median home value. Comparing home values among communities is difficult because of the wide range of assessed values within each community.

One informative way to compare these values is to look at the median value because this is the value where half the homes are valued more than this amount and half the homes are valued at less than this amount. This median or “middle” home value allows comparisons to be made between communities. So to say that median home values in the Mahomet-Seymour School District are the highest doesn’t mean that all the home values are higher than those in the other communities, it is a comparison of the “middle” home value among those communities.

These types of comparisons using medians are often used by local government entities. For example, the Village of Mahomet provides comparative median information in the 2023 Village of Mahomet budget proposal to be presented at the Board of Trustees meeting on May 24. The Village provides data that shows the median homeowner occupied home value within the Village is $243,000 which they compare to the median home values in Champaign County and the State of Illinois.

Village provided data for 2020 Median Homeowner Occupied Housing

| Champaign County | Illinois | United States | Village of Mahomet |

| $166,600 | $202,100 | $229,800 | $243,000 |

*note Village of Mahomet residents are only part of the entire Mahomet-Seymour School District. This chart is in market value: assessed, taxable value would be one-third of this amount.

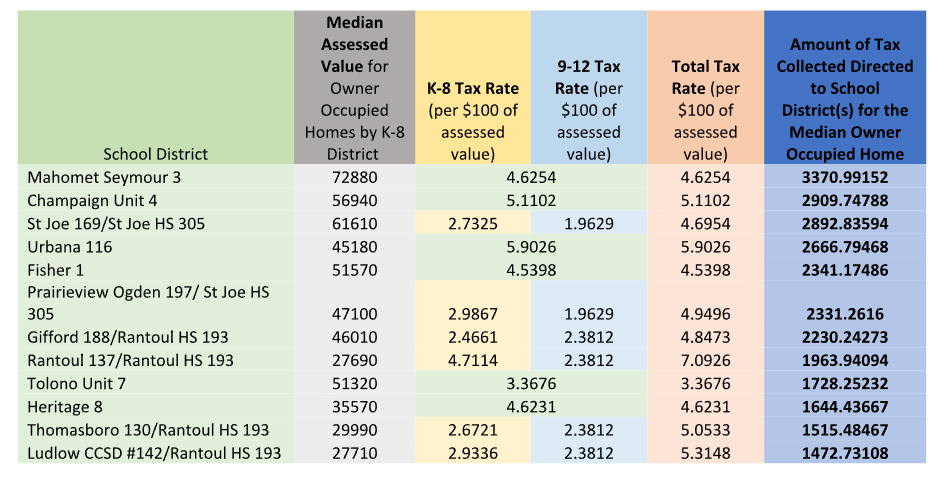

Here’s how this plays out in rates and dollars for the median homeowner in each school district:

*Median-assessed home values are one-third of market value. Multiplying the assessed value by three would give the approximate market value of a home. Exemptions for homeowners vary and so are not included in the amounts above.

As with the assessed values, the tax values are medians meaning that half the people in Mahomet-Seymour will pay more than $3370.99152 and half will pay less than that amount.

As Mahomet-Seymour voters go to cast their ballot in the 2022 primary election, they will also have the opportunity to vote on a $97.9 million referendum, to build a new junior high, a bus barn and other upgrades as funds are available.

This will increase the Mahomet-Seymour tax rate to 5.5654-percent (using the district’s estimate of interest at 3.5-percent), moving the tax rate up to #3 in comparison to the other 15 districts in Champaign County.

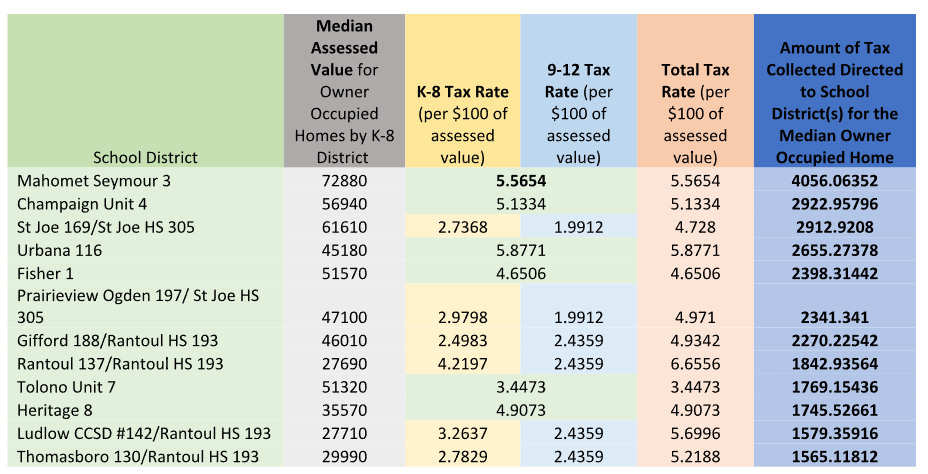

For perspective, here is what the spread between taxes paid to a school district will look like in Champaign County should Mahomet-Seymour’s referendum pass.

*Median Assessed home values are one-third of market value. Multiplying the assessed value by three would give the approximate market value of a home. Exemptions for homeowners vary and so are not included in the amounts above.

Again recall that these values are medians meaning half the people in the Mahomet-Seymour School DIstrict will pay more than $4056.06352 and half will pay less than that amount based on assessed value.

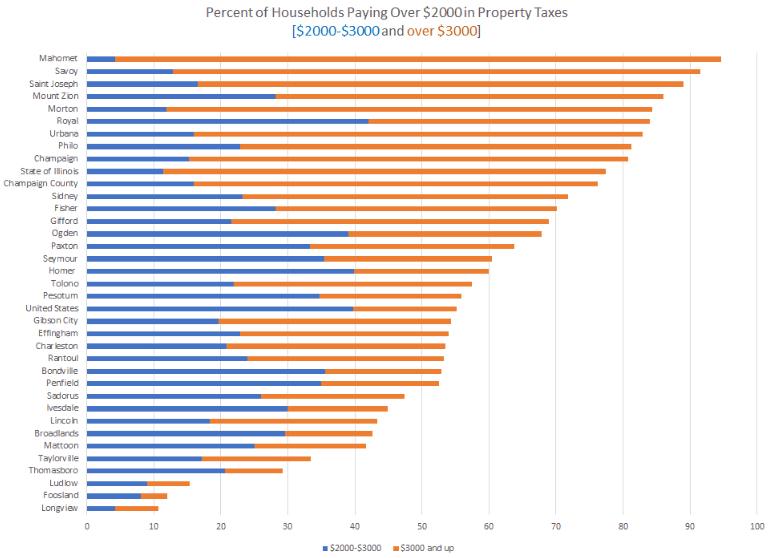

While Mahomet-Seymour School District’s portion of every tax dollar is approximately 58-percent, the complete picture on tax dollars paid to taxing entities within each community might be better told with data from Data USA showing the percentage of residents who pay more than $2000 to $3000 per year in Champaign County. Data from other Apollo Conference schools, like Taylorville, Mattoon, Charleston, Effingham Mount Zion and Morton was added for perspective.

*data compiled from Data USA

Mahomet and Savoy lead the graph with over 90-percent paying more than $2,000 to $3,000 in taxes each year. In passing the 2022 Mahomet-Seymour referendum, that percentage will likely increase.

For Mahomet, that includes the Champaign County Government’s rate at 0.8342; the Champaign County Forest Preserve’s rate at 0.1073; Parkland College’s tax rate at 0.5378; Cornbelt Fire Protection District at 0.3602; Mahomet Township at 0.1192; Mahomet Road and Bridge at 0.3207; and the Mahomet Public Library at 0.306-percent.

Vote no on the referendum