Residents and visitors to Mahomet should expect to see a new 1.0% tax on most purchases within the village’s business district starting January 1, 2025. This tax, approved when the Village of Mahomet established a Business District, will affect retail and service transactions as part of the village’s plan to redevelop areas designated as “blighted.”

The term “blighted” refers to areas that suffer from deteriorating infrastructure, inadequate planning, or economic underutilization, resulting in them becoming liabilities to the surrounding community. In urban planning and development, a blighted area often exhibits signs of neglect, such as dilapidated buildings, poor street layouts, or insufficient public services, which discourage private investment. Designating an area as blighted allows local governments to implement redevelopment plans, often through tax incentives or special funding, to revitalize the region, attract businesses, and improve the overall quality of life for residents.

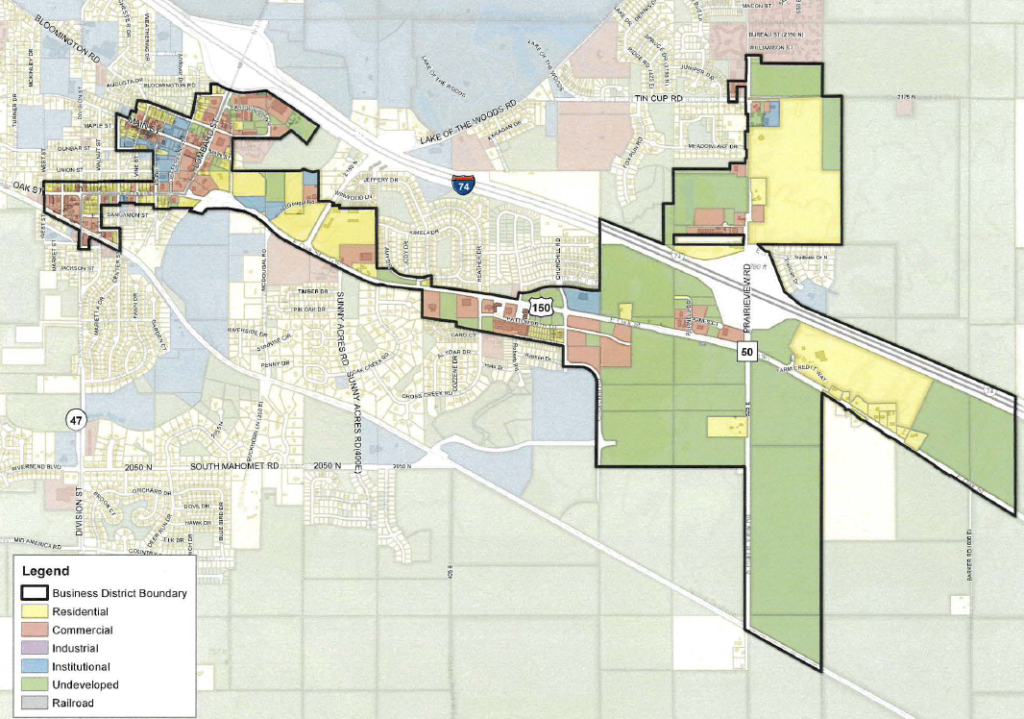

The Business District, which covers 357 parcels along key corridors such as IL-47 and US-150, aims to revitalize areas that have not seen significant private investment in recent years. The district includes properties south of the I-74/IL-47 interchange and stretches through downtown Mahomet and other adjacent areas. It has been identified as “blighted” due to deteriorating infrastructure, improper subdivision, and economic underutilization.

The designated area also includes areas that are already receiving funds from TIF, including the East Mahomet TIF and the Downtown TIF.

The key component of this district’s establishment is the imposition of a 1.0% Business District Retailers’ Occupation Tax and Service Occupation Tax on most purchases made within the district. These taxes, while not applicable to essential goods like food or prescription medications, will apply to most retail and service transactions. Additionally, a 1.0% hotel occupancy tax will be imposed on rooms rented within the district. Revenue generated from these taxes will be allocated toward infrastructure improvements, such as upgrading utilities, streets, and sidewalks, and facilitating redevelopment projects.

Since 2010, consumers in Champaign County have been paying a similar tax to help school districts pay off bonds and provide facility updates.

The business district plan outlines goals such as recruiting new retail businesses, retaining small businesses, and improving the sales and property tax bases. These improvements are intended to benefit the village as a whole by increasing property values and generating more revenue for public services.

According to village officials, the district’s redevelopment efforts could take up to 23 years, during which time the taxes will remain in place. After that period, or upon the repayment of all obligations, the taxes will be lifted.

The Village of Mahomet board unanimously approved the business district and its accompanying tax in the summer of 2024. The tax can be implemented without the need for a public referendum.